ASRA Guide to the Medicare Fee-for-Service Recovery Audit Contractor Program

The Medicare Fee-for-Service (FFS) Recovery Audit Contractor (RAC) is a program run by the Centers for Medicare and Medicaid Services (CMS) to support its program integrity efforts. Its mission is “to identify and correct Medicare improper payments through the efficient detection and collection of overpayments made on claims of health care services provided to Medicare beneficiaries, and the identification of underpayments to providers so that the CMS can implement actions that will prevent future improper payments in all 50 states.”

CMS contracts with RACs, which are authorized to review claims on a post-payment basis and to recoup overpayments. RACs are paid on a contingency basis such that, generally, they receive payments based on the amount of improper payments they identify and recoup; they may also receive payment related to underpayments identified.

Who are the RACs?

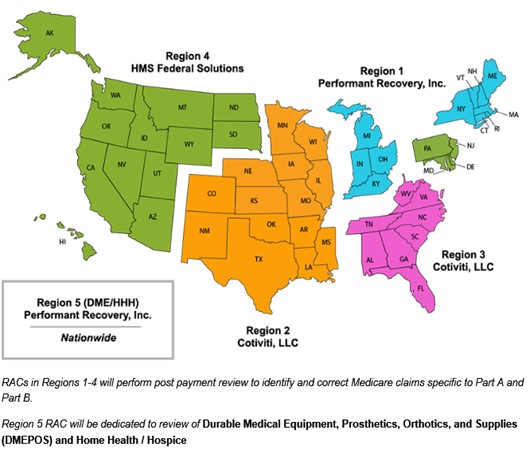

There are currently 5 RACs, which conduct reviews in one of 5 regions – including one nationwide region that focuses only on durable medical equipment, prosthetics, orthotics, and supplies (DMEPOS), as well as home health and hospice services. See the table and map below for additional information.

| Region | States | Websites | Phone Number | |

| Region 1 Performant Recovery, Inc. | CT, IN, KY, MA, ME, MI, NH, NY, OH, RI, and VT | https://performantrac.com/ PROVIDERPORTAL.aspx | info@Performantrac.com | 1-866-201-0580 |

| Region 2 Cotiviti, LLC | AR, CO, IA, IL, KS, LA, MO, MN, MS, NE, NM, OK, TX, and WI | https://Cotiviti.com/RAC | RACInfo@Cotiviti.com | 1-866-360-2507 |

| Region 3 Cotiviti LLC | AL, FL, GA, NC, SC, TN, VA, WV, Puerto Rico and U.S. Virgin Islands | https://www.Cotiviti.com/RAC | RACInfo@Cotiviti.com | 1-866-360-2507 |

| Region 4 HMS Federal Solutions | AK, AZ, CA, DC, DE, HI, ID, MD, MT, ND, NJ, NV, OR, PA, SD, UT, WA, WY, Guam, American Samoa and Northern Marianas | https://racinfo.hms.com/ home.aspx | racinfo@emailhms.com | Part A: 1-877-350-7992 Part B: 1-877-350-7993 |

| Region 5 DME/HHE/ Performant Recovery, Inc. | Nationwide for DMEPOS/HHA/ Hospice | https://performantrac.com/ PROVIDERPORTAL.aspx | info@Performantrac.com | 1-866-201-0580 |

Source: CMS

What Types of Reviews Can RACs Conduct?

RACs are authorized to conduct one of the two following types of reviews[1]:

- Automated reviews. Automated review occurs when a RAC makes a claim determination at the system level without a human review of the medical record. In general, RACs may use automated review when making both coverage and coding determinations only where there is certainty that the service is not covered or is incorrectly coded AND a written Medicare policy, Medicare article, or Medicare-sanctioned coding guideline exists. Automated review may be made for other types of determinations (e.g. duplicate claims, pricing) when there is certainty that an overpayment or underpayment exists, even if written documentation does not exist.

- Complex reviews. Complex review occurs when a RAC makes a claim determination utilizing human review of the medical record or other required documentation. RACs may use complex review in situations where there is a high probability (but not certainty) that the service is not covered or where no Medicare policy, Medicare article, or Medicare-sanctioned coding guideline exists.

What Types of Claims Can RACs Review?

RACs can review any type of Medicare Part A or B claim, provided the service is included under an Approved RAC Topic. The following information is included for each approved RAC topic:

- Issue name

- Date of approval

- Review type

- Provider types

- MAC jurisdiction

- Description of what is being reviewed

- Affected code

CMS also posts information on Proposed RAC Topics for at least 30 days for provider review and feedback, prior to topics being moved to the Approved RAC Topic list.

Is There a Limit on the Age of a Claim that a RAC Can Review?

RACS may only review claims up to three years after the original claim paid date documented in the Common Working File. No overpayment notification letters (for automated reviews) or request letter (for complex reviews) can be issued beyond the three-year period.

What Types of Improper Payments Can RACs Identify?

In general, RACs may attempt to identify improper payments (overpayments or underpayments) that result from any of the following:

- Incorrect payment amounts (Exception: in cases where CMS issues instructions directing contractors to not pursue certain incorrect payments made);

- Non-covered services (including services that are not reasonable and necessary under Section 1862(a)(1)(A) of the Social Security Act);

- Incorrectly coded services (including DRG miscoding);

- Duplicate services

CMS may not attempt to identify improper payments from any of the following:

- Services provided under a program other than Medicare FFS

- Cost report settlement processes and Medical Education payments

- Claims more than three (3) years past the date of the initial determination

- Randomly selected claims

- Claims identified with a Special Processing Number (such claims are involved in a Medicare demonstration or have other special processing rules that apply)

What Can I Expect from a RAC Review?

For automated reviews:

Providers will generally receive an initial communication from a RAC (sometimes called an Initial Findings Letter or Informational Letter); for some RACs, the notification may be furnished via a Provider Portal. Providers should review the communications carefully to understand the options available to them.

For complex reviews:

Providers and suppliers will generally receive an Additional Documentation Request (ADR) from a RAC via first class mail. The number of ADRs that each RAC can issue for a given provider are subject to limits, as detailed in the links below:

Providers will then have 45 days to submit the requested medical record documentation. Medical records may be submitted by mail (e.g., in paper copy or on a CD or DVD), by fax, or via electronic submission via the CMS Electronic Submission of Medical Documentation System (esMD).

RACs may deny claims where documentation is not submitted; however, they must initiate at least one additional contact with the provider before denying the claim. RACs must also allow all providers at least one extension for the submission of additional documentation.

Once the RAC has received the medical record documentation, it must generally complete its review within 30 days and then issue a Review Results Letter with the findings.

RACs are required to clearly document the rationale for the review determination in the Review Results Letter. The rationale must include a detailed description of the Medicare policy or rule that was violated and a statement as to whether the violation resulted in an improper payment. RACs must identify pertinent facts contained in the medical record/documentation to support the review determination, and each rationale must be specific to the individual claim under review.

For both automated and complex reviews:

Providers will generally have 30 days from the date of the notification (i.e. the Discussion Period) to review the audit findings, and if desired, request a Discussion with the RAC. Discussion Period Requests must be submitted on a claim-by-claim basis. If a Discussion Period Request is submitted, the RAC must send confirmation of receipt of the request within 1 business day. The RAC must then respond to the discussion request within 30 days and notify the provider of the outcome with a detailed, written rationale.

Following 30 days from the date of an improper payment notification, as applicable, or after a Discussion Period has been completed without a change in the status of the identified improper payment, the RAC will forward the claims adjustment to the MAC. The MAC will review the adjustment and will initiate a Demand Letter and claim adjustment.

Note: In some cases, CMS may approve the use of extrapolation for some claim types when applicable requirements are met.

Can I Get Reimbursed for the Cost of Medical Records?

RACs are generally required to reimburse providers for the submission of medical records in response to ADRs. Payment for inpatient hospital and long-term care facilities will be in the amount of $0.12 cents per page plus first-class postage. Records will be reimbursed at $0.15 cents per page plus first class postage for non-PPS institutions or practitioners.[2] Reimbursements are subject to maximum reimbursement amounts of $27 for records submitted (which includes a $2 transaction fee per record) via esMD and $15 for all other submission types.

What Information Do RACs Use to Make Improper Payment Determinations?

RACs are required to comply with all national coverage determinations, national coverage/coding articles, local coverage determinations, local coverage/coding articles, and provisions in Internet Only Manuals. In addition, RACs are required to comply with all applicable change requests and Technical Direction Letters forwarded to the RAC by CMS.

What Type of Payment Adjustments Can Be Made?

RACs are not allowed to attempt recoupment if the anticipated amount of the overpayment is less than $25, excluding claims reviewed by extrapolation. Additionally, adjustments for underpayments less than $5 are not allowed.

Can I Appeal a RAC Finding?

Providers are given appeal rights for Medicare overpayments and underpayments determined during the RAC review process. Providers can request an appeal after they have received a Demand Letter from a Medicare Administrative Contractor (MAC). Appeals are conducted through the MAC (not the RAC), and providers should follow the same process for appeals as they would follow with other appeals to MACs. RACs are expected to work with other CMS contractors to support an accurate and fair adjudication.

Do RACs Have Customer Service Requirements?

RACs are required to maintain a Medicare FFS RAC website to communicate to the provider community helpful information on the program. The Medicare FFS Recovery Audit Program information must appear on pages that are separate and distinct from any other non-Medicare work the RAC may have. The websites must post information on all approved review topics, including, at a minimum, the review issue name, description, date of CMS approval, the posting date, state(s)/MAC regions applicable, review type, provider type, affected code(s), and applicable references. At a minimum, the approved review listing must be sortable by provider type, review type, posting date, and state/MAC region.

RACs are also required to develop and use a secure web-based application, or provider portal, that will allow all provider types to view up-to-date information regarding the status of their claim reviews. The provider portal must include the following information:

- The provider’s overall ADR limit

- Dates of all ADR letters

- The date that the medical documentation was received for each claim being reviewed

- The date that medical review of the documentation began

- The date that medical review of the documentation was completed

- The outcome of the review (overpayment, underpayment, no finding)

- Discussion period information

- Appeals outcomes

- Case closure date

RACs are required to update all dates and status information within 5 calendar days.

RACs are required to provide a toll-free customer service telephone number in all correspondence sent to Medicare providers or other prospective debtors. The customer service number must be staffed by qualified personnel during normal business hours from at least 8:00 a.m. to 4:30 p.m. in each applicable time zone. Customer service staff must be available to providers on all business days except for federal holidays. After normal business hours, a message must indicate the normal business hours for customer service. All messages playing after normal business hours or while on hold must be approved by the CMS before use.

RACs are required to respond to written correspondence, including mailed and faxed documents, within 30 days of receipt. RACs are required to confirm receipt of such correspondence within one business day.

RACs are required to respond to all email inquiries within 2 business days of receipt. RACs are required to confirm receipt of such correspondence within one business day.

Resources

The following sources were used in the preparation of this guide. All materials were accessed June 2, 2021.

- CMS. Medicare Fee for Service Recovery Audit Program. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program/Index.html

- CMS. Medicare Program Integrity Manual, Chapter 3 – Verifying Potential Errors and Taking Corrective Actions. October 2, 2020. https://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/pim83c03.pdf

- CMS. Statement of Work (SOW) for the Part A/B Medicare Fee-for-Service Recovery Audit Contractor (RAC) – Region 1. March 26, 2001. https://www.cms.gov/files/document/rac-sow-region-1-march-26-2021.pdf

- CMS. Statement of Work (SOW) for the Part A/B Medicare Fee-for-Service Recovery Audit Program – Regions 1-4. November 30, 2016. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program/Downloads/RAC-SOW-Regions-1-4-clean-November-30-2016.pdf

- CMS. Recovery Audit Program Improvements – Completed (as of October 31, 2016). November 24, 2017. https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program/Downloads/Recovery-Audit-Program-Improvements-November-24-2017.pdf

- Coviti LLC. Recovery Audit Contractor (RAC) Program – Frequently Asked Questions. April 8, 2019. https://info.cotiviti.com/hubfs/CMS_RAC/assets/Frequently-Asked-Questions-CMS-RAC-(updated-2019-04-08).pdf

- HMS Federal Solutions. RAC Claim Review & Recovery Audit Process. https://racinfo.hms.com/Public1/Forms/CMS/RAC_Region4_RecoveryAuditProcess.pdf

- Performant Recovery Inc. CMS Recovery Audit Contractor (RAC) Program – Frequently Asked Questions by Providers v.5. https://performantpayments.q4cdn.com/496166601 /files/doc_downloads/resources/supporting_cms/RAC-FAQs-v5.docx

[1] CMS also notes that, at its discretion, it may require RACs to review claims based on referrals from other contractors, like Medicare Administrative Contractors and Unified Program Integrity Contractors, or from Federal investigative agencies, like the Department of Justice or the Office of Inspector General. Requirements and policies for such reviews may vary from the information included in this guide.

[2] Providers under a Medicare reimbursement system (such as Critical Access Hospitals) receive no reimbursement for submitting medical records. Also, payments will not be made for blank pages or documents/records that are not related to the claim being reviewed.

Prepared by Hart Health Strategies, Inc. – June 2021

This guide is intended for informational purposes only, without warranty, and is not intended to serve as legal advice. Language included in this guide reflects information collected and synthesized across CMS and RAC websites and posted materials at the time this guide was prepared, which may be subject to change. Language may reflect verbatim language from these sources and may or may not be included in quotes.

Leave a commentOrder by

Newest on top Oldest on top